What I’m reading: States lag on energy efficiency, record U.S. clean energy deployment, tax credit uncertainty, and more

Quitting Carbon is a 100% subscriber-funded publication. To support my work, please consider becoming a paid subscriber or making a one-time donation.

Ahead of the weekend, here is another roundup of highlights from some of what I've been reading. Enjoy!

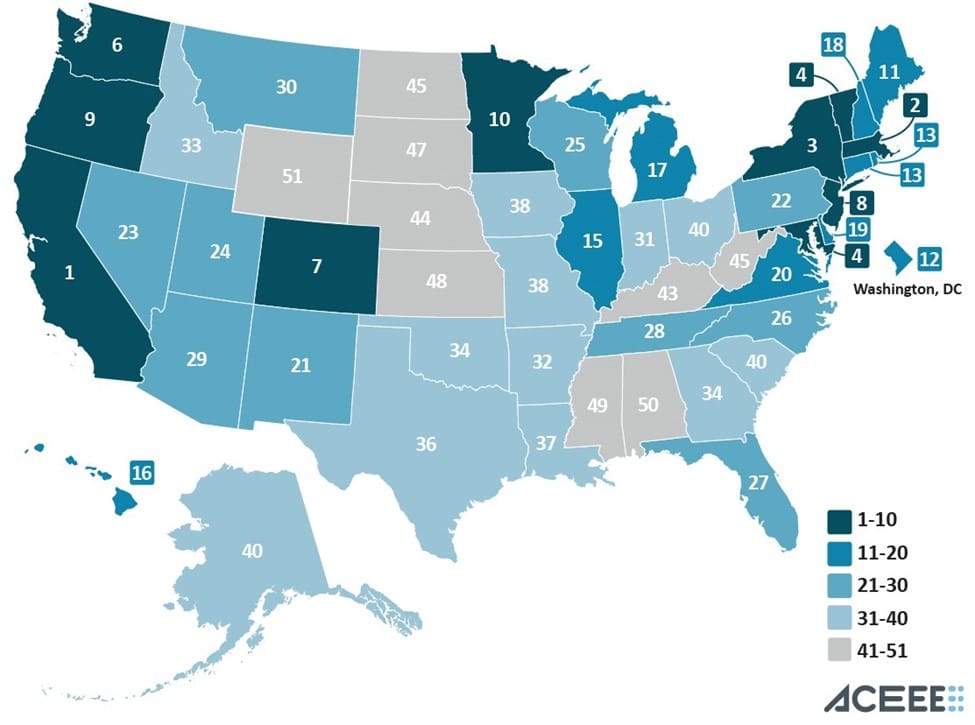

States lagging on energy efficiency: Far too many U.S. states are leaving energy savings on the table, finds the American Council for an Energy-Efficient Economy’s latest annual energy efficiency scorecard. Energy efficiency investments reached a record high of $8.8 billion in the survey but more than 90% of the increase came in just five states – Massachusetts, Missouri, New Jersey, New York, and Pennsylvania. California claimed the top spot in the rankings for the seventh time.

A big, missed opportunity for states is a lack of action to update outdated or even non-existent building energy codes. Only six states have fully adopted the most recent model building energy code (e.g., the International Energy Conservation Code or ASHRAE Standard 90.1), and nine states have no statewide building energy code at all, according to ACEEE.

Trump’s funding freeze stalls push to electrify U.S. ports: A few days before Donald Trump was sworn in for his second term, I published a Q&A with Matt Davis from the Port of Oakland about the $322 million grant the port had received from the U.S. EPA’s Clean Ports Program to buy hundreds of zero-emissions trucks and cargo-handling vehicles. I asked Davis if he was concerned the Trump administration would try to claw back the funding. “Our board took an action to accept the grant in late December, so we have a formally obligated grant from the EPA. Obviously, we're going to be very hopeful, and we're going to continue to plan as if all the funding will be released,” he said.

The question is even more salient after reporting earlier this month from Energy Wire’s David Ferris on the uncertain status of similar grant funding worth $1.1 billion in the Los Angeles Basin, including funds targeted for the Port of Los Angeles. “People have projects and jobs counting on these funds, and they don’t know what they should be doing right now. It’s massively disruptive and it’s confusing,” the Environmental Defense Fund’s Jason Mathers told Ferris. I’ll reach out to the Port of Oakland and report back on whether its EPA grant funding has been affected by the ongoing funding freeze.

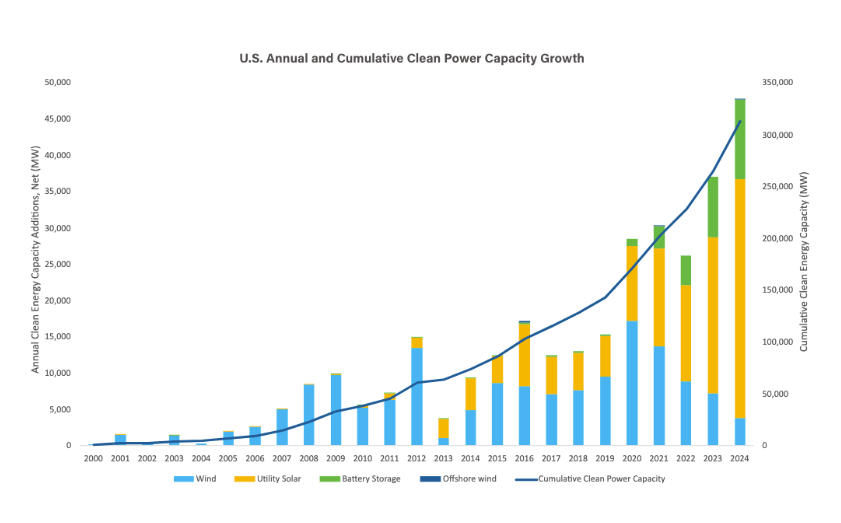

Record-breaking U.S. clean power deployment: Boosted by incentives in the Inflation Reduction Act, U.S. clean energy deployment hit a record 49 gigawatts (GW) of capacity in 2024 – a 33% increase over the previous record of 37 GW set in 2023, according to a new report from the American Clean Power Association (ACP). Ninety-three percent of the new power capacity that came online last year was solar, wind, and battery storage. “After taking more than 40 years to build the first 200 GW of utility-scale clean power capacity, it took just three years to build an additional 100 GW (2022-2024),” according to ACP.

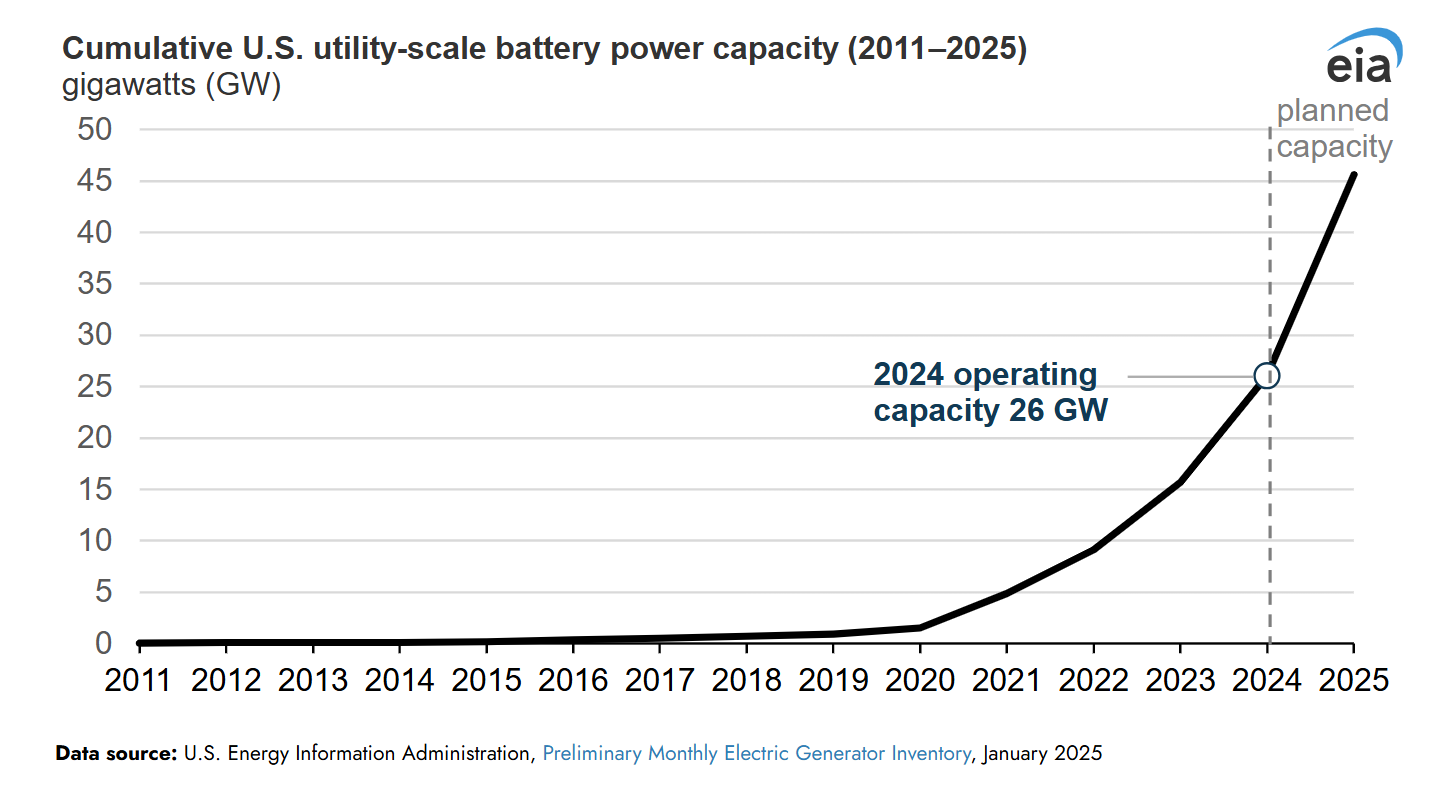

U.S. battery deployment could set a record in 2025: The U.S. battery storage boom is expected to continue this year. According to the latest data from the U.S. Energy Information Administration (EIA), 10.4 GW of utility-scale battery storage capacity was added to the U.S. grid last year, boosting cumulative capacity to more than 26 GW. New battery capacity growth could set a record in 2025, with developers planning to install 19.6 GW utility-scale projects to the grid this year, according to EIA.

Tax credit uncertainty could slow investment: The record-setting clean energy deployments mentioned above could be at risk, however, if Republicans in Congress move to amend or rescind the federal clean energy tax credits in the IRA. A December 2024 survey of clean energy sector investors and developers released this week by the American Council on Renewable Energy (ACORE) warns that uncertainty over the status of the tax credits could cool future investment.

Absent changes to the tax credits, or other policy interventions, more than half of the survey respondents reported plans to increase their activity by more than 10% compared to 2024 levels, over the next three years. “Conversely, tax credit uncertainty could cause 84% of investors and 73% of developers to decrease their activity in clean energy. Among companies with over $1 billion in investments, 80% responded that they would significantly or moderately decrease their clean energy investment plans, potentially translating to the loss of tens of billions of dollars in private sector investment,” according to ACORE.

Scrapping tax credits would raise utility bills: Repealing the IRA’s clean energy tax credits would hurt consumers, too, finds a new report from think tank Energy Innovation. According to the report, IRA repeal would: increase cumulative household energy costs by $32 billion from 2025-2035; cost America nearly 790,000 jobs in 2030 and more than 700,000 jobs in 2035; decrease GDP more than $160 billion in 2030 and nearly $190 billion in 2035; and increase climate pollution more than 530 million metric tons of carbon dioxide equivalent in 2035, equal to adding 116 million cars to the road.

“We looked at a state-by-state level at energy bills as well as jobs and economic growth. Across the board, repealing the IRA is going to make it more expensive for the average household – and in some states, dramatically,” Energy Innovation’s Robbie Orvis told Canary Media’s Jeff St. John.

Full repeal unlikely: A full repeal of the Inflation Reduction Act appears increasingly unlikely, however, based on the growing number of Republicans in Congress who support preserving the bill’s clean energy tax credits. In a letter shared with Politico on March 10, 21 House Republicans pledged support for the tax credits.

"We have 20-plus members saying, ‘Don’t just think you can repeal these things and have our support,'" Rep. Andrew Garbarino (R-NY), who organized the letter, told Politico’s Josh Siegel and James Bikales.

"We need the projects that are currently under development to be brought online so we can continue the President’s 'America First' agenda," he added. "These [credits] are helping the president accomplish what he said he wanted to do in his campaign, and that was to make America an energy dominant country."

Bonus: Getting gas out of new buildings in Ashland: In recent years, my family’s holiday tradition has been to spend the week between Christmas and New Year’s in Portland, Oregon. Weather permitting – we have been caught in a snowstorm on I-5! – the perfect halfway point on the drive north from my home in the San Francisco Bay Area is the city of Ashland, Oregon.

The city is probably best known for its long-running Oregon Shakespeare Festival. But I love simply walking the main street of Ashland’s quaint, thriving downtown, taking in the holiday season charm, especially when the city has been dusted by snow.

My affinity for Ashland deepened recently after reading that the city council had imposed a fee on new fossil gas hookups in buildings. The best part? The ordinance to enact a fee to discourage the installation of gas appliances in new homes was brought to the council by a youth group called the Rogue Climate Action Team nearly two years before.

“We’re gonna need this feeling because it’s rough out there right now, you know. We all know what’s going on. But this is why it’s more possible than ever for us to build power together, because we need each other,” said Rogue Climate Organizing Director Jess Grady-Benson after the city council’s unanimous decision to support the new ordinance in February.