California is preparing to add marine energy to its power mix

Spurred by recent legislation, California regulators are planning for the day when wave and tidal energy projects join the grid.

Quitting Carbon is a 100% subscriber-funded publication. To support my work, please consider becoming a paid subscriber or making a one-time donation.

History shows us that when California throws its weight behind an emerging energy technology, it can help push the technology to a commercial scale.

California gave early, critical support to help commercialize onshore wind, rooftop solar, electric vehicles, and battery energy storage. It is attempting to do the same for floating offshore wind.

Can the state now do so for the nascent marine energy sector?

Marine energy was an emerging sector when I first reported on it more than a decade ago; it remains so today. It turns out that getting devices in the water to harness the power of the waves and tides and converting it into electricity – and doing it at a reasonable cost – has proved challenging. Among the obstacles to overcome are building devices that can withstand punishing conditions in the open ocean and standardizing designs to reduce costs and speed deployment.

So, it is promising that California is now investigating whether marine energy has a place in its future electricity mix as the state pursues a zero-carbon grid over the next two decades.

In October 2023, Governor Gavin Newsom (D) signed SB 605, legislation authored by state Senator Steve Padilla (D) that directs the California Energy Commission (CEC) “to evaluate the feasibility, costs, and benefits of using wave energy and tidal energy” and “to work with other state and local agencies and stakeholders to identify suitable sea space for offshore wave energy and tidal energy projects in state and federal waters.”

The legislation also requires the CEC to submit a final report to the governor and Legislature that summarizes this research and provides recommendations for lawmakers.

The CEC completed the first assignment by publishing a report evaluating the feasibility, costs, and benefits of wave and tidal energy in November 2024. As for the second assignment, commission staff and consultants presented a draft report at an online workshop last week that is a first attempt to identify suitable sea space for wave and tidal energy projects in California.

Substantial wave and tidal energy resources are available to be tapped in California if state officials can prepare the way for projects.

“While commercial-scale marine energy projects in California have not been implemented to date, the state's abundant wave resources and supportive policy environment present opportunities for further research, development, and demonstration to support large-scale deployment of marine energy technologies,” writes Aspen Environmental Group in the November 2024 report, which was prepared for the energy commission.

“Wave and tidal energy resources can provide consistent generation and are zero-carbon and renewable resources that can help the state achieve its climate policy goals,” the authors conclude.

Tapping the available resources

How large is the potential resource?

The National Renewable Energy Laboratory (NREL) has estimated the total marine energy resource in the U.S. at 2,300 terawatt-hours (TWh) per year – equivalent to about half of the electricity generated nationwide.

The same NREL research estimates California’s wave energy resource alone at more than 37 gigawatts, capable of generating up to 140TWh per year. The California Wave Energy Assessment found that wave energy has the potential to provide 23% of the state’s electricity.

But those numbers represent the technical feasible potential for marine energy in the state. Successfully deploying projects that get California anywhere close to realizing that potential will require a huge push to advance an industry that has been frustratingly slow to mature.

One of the major hurdles to overcome is the lack of standardization in the sector. Researchers, startups, and project developers have proposed, designed, and tested a dizzying array of devices.

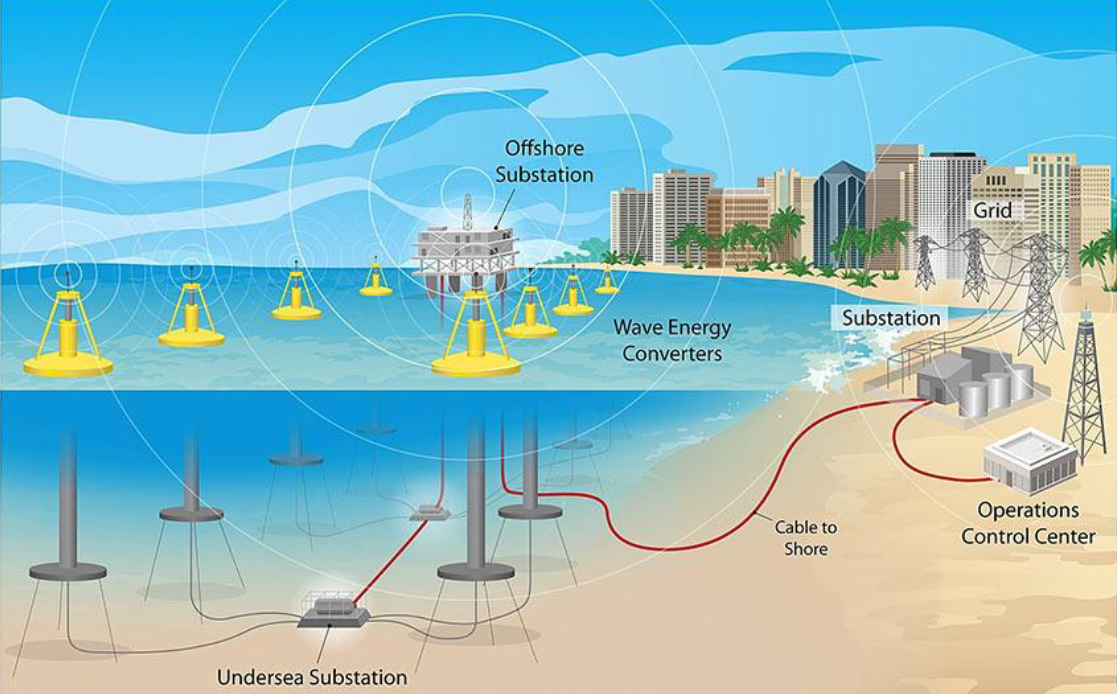

So many unique designs have been put forward that the CEC identified six categories of wave energy converter technologies alone. The devices may be installed onshore and attached to a fixed structure such as a pier, or they may be floating or submerged, whether mounted directly to the seafloor in shallow water near shore (in water depths of 10-25 meters) or deployed in deep water (>25 meters) and held in place with moorings and anchors.

Where is the best resource?

California is blessed with 840 miles of often stunning coastline. Which means the potential for wave and tidal energy development is vast.

But once you remove sites that have military, conservation, shipping, cultural, or historical (there are more than 1,500 shipwrecks along the California coast!) constraints, the range of suitable sites is much reduced.

“The level of energy available from waves and tides is very different,” noted Grace Chang, senior science advisor and director of research and development, Integral Consulting Inc., during last week’s workshop. “The amount of wave power that could feasibly be extracted off the coast of California is about two orders of magnitude, or 100 times the amount of power available from tidal resources.”

Tidal energy opportunities in California are limited and the best sites such as San Francisco Bay and the Carquinez Strait are mostly unavailable because of conflicts or exclusion zones.

As is the case for floating offshore wind, many of the best sites for potential wave energy development are in Northern California, a region located several hundred miles from the state’s largest cities and lacking connections to the Golden State’s north-south transmission backbone.

“While there are abundant wave energy resources off the coast of California, the greatest resources are in the northwest of the state, far from major population centers. The highest energy locations for WECs [wave energy converters], particularly at the grid scale, are also located some distance offshore,” the authors of the new draft sea space analysis report conclude. The report was prepared by Aspen Environmental Group, Integral Consulting, and H.T. Harvey & Associates for the CEC.

Northern California has the highest overall wave power of the state’s three regions “with medium to high levels found across the entire region. There are some areas where higher power is available relatively close to shore, which is due in part to underwater features and canyons found in Northern California that result in deeper water closer to shore and focusing of wave energy,” said Chang during the workshop.

“Importantly, most of the highest wave resources are located outside of constraint zones,” she added.

Oregon’s PacWave South

What the marine energy sector in California and beyond really needs is more rigorous, real-world testing to determine whether prototypes can survive in the water and to hasten the winnowing of designs to a handful of reliable and viable devices that can compete on cost with other renewable energy technologies.

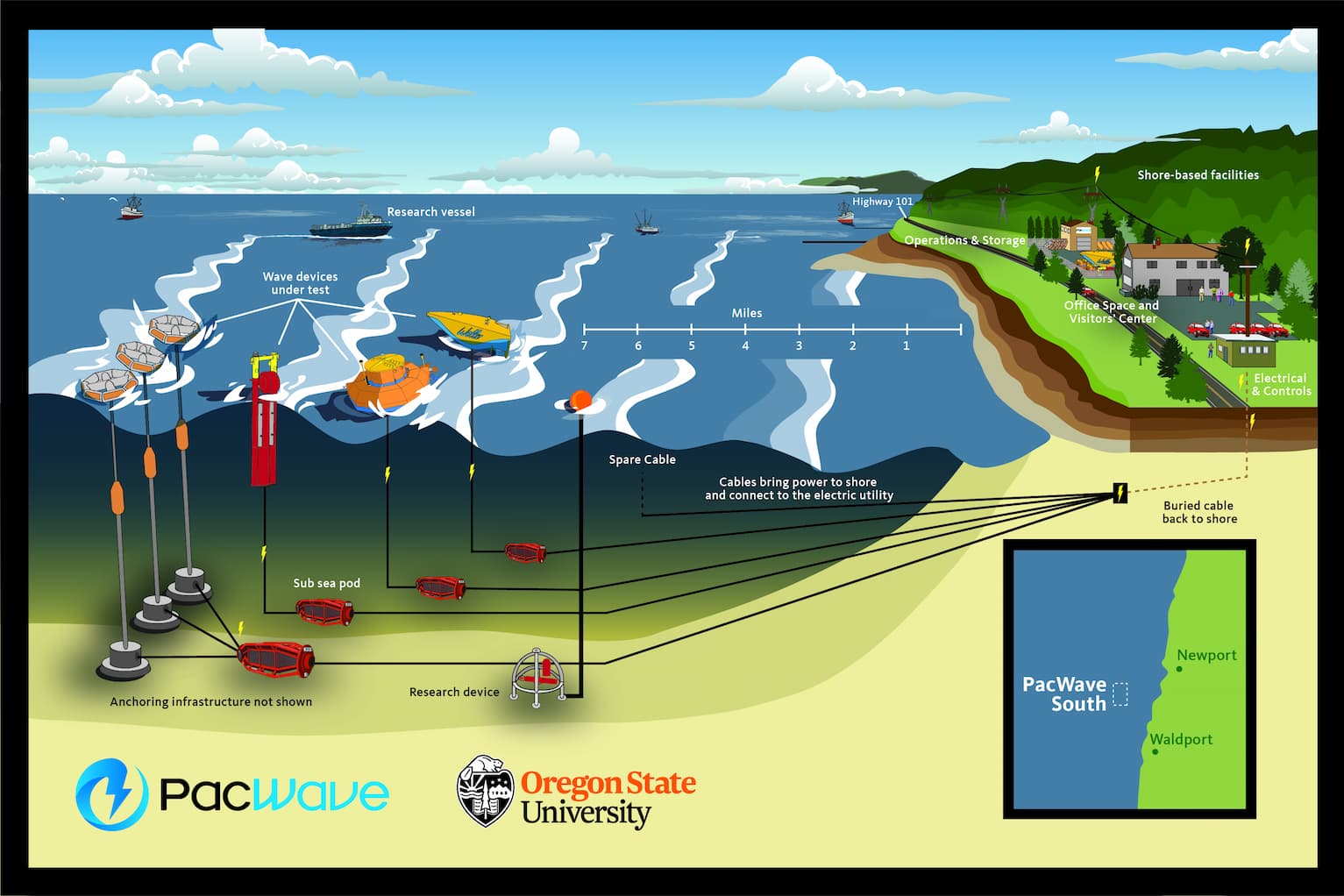

It so happens that a facility will soon open about 275 miles north of the California border to do just that. Oregon State University is building the PacWave South project grid-connected wave energy test facility about seven miles offshore Newport on Oregon’s central coast. I mentioned this project in my first What I’m Reading roundup in November 2024.

The facility can accommodate up to 20 wave energy converters in four berths, with a total installed capacity of 20 megawatts (MW). Each berth comes with a 5MW power and data cable connection to a shoreside utility connection and monitoring facility.

Construction on the facility is expected to be completed early this year. Developers are expected to begin testing wave energy converters in spring of 2026.

“As PacWave South is pre-permitted for the majority of wave energy device types, clients will not have to undertake a costly and time-consuming permitting process prior to testing at the site. This will allow for more rapid optimization of designs,” according to PacWave.

Getting projects in the water

The launch of the PacWave South test facility is a huge step forward for the marine energy sector in the U.S.

According to the CEC, as of late 2023, the only active wave energy projects in the country that have secured Federal Energy Regulatory Commission licenses are associated with wave energy test sites like PacWave South and the Hawai’i Wave Energy Test Site.

Early projects in California such as Pacific Gas and Electric’s Humboldt WaveConnect project in Northern California did not move forward. But more recent efforts have been more promising.

Oakland-based startup CalWave completed a 10-month open-ocean deployment of its xWave device off the coast of San Diego in July 2022. The pilot project “represented the company’s (and California’s) first at-sea, long-duration wave energy project,” according to the U.S. Department of Energy. CalWave next plans a two-year validation of its x100 device at PacWave South.

And just last month, Eco Wave Power received a final construction permit from the Port of Los Angeles to install eight of its wave energy floater devices on the piles of a concrete wharf in San Pedro. Construction is scheduled for completion by the end of the second quarter of this year.

But for marine energy to find a place in California’s electricity mix of the future, developers must find a way to reduce the cost of deploying the technology.

“The levelized cost of energy (LCOE) of pilot-scale wave energy projects has been estimated to range between $0.37/kWh and $1.22/kWh. In their 2021 report, [B.G.] Reguero and [P.] Menendez reported LCOE of new WEC technologies on the order of $0.55/kWh, which is three times higher than conventional sources and four times higher than other renewables (solar and wind),” finds the November 2024 CEC report.

But if developers can prove designs at PacWave South, and if California lawmakers follow up on the SB 605 reports and recommendations with financial support to deploy projects, marine energy could contribute to the state’s carbon-free grid in the coming decades.